Depreciation

Oil and Gas operations typically involve huge quantity and variety of equipment, installations, facilities and machinery. Most of these are depreciable assets, because they are used for production of income, have an expected (and defined) life of more than a year and lose value from year to year because of their use. Investment made on these depreciable assets is allocated along the fiscal periods when the asset is in use and producing income, so it can be deducted from the income as an expense. This allocation of the expense along time is what we call depreciation of the asset and it is very important in some cash flow models.

Depending on the objectives of the cash flow model, several different ways of expense allocation and depreciation calculation are available. Different fiscal regimes impose different depreciation methods.

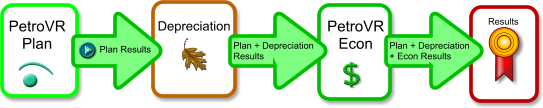

PetroVR supports depreciation of capital expenses on wells, facilities, and scheduled jobs that have an editable CapEx in the Cost pane (including Facility Construction jobs, which stand for the facility itself), which represent or involve acquisition or construction of some depreciable asset. These can be depreciated either individually or by defining Cost Categories. For each asset or category the user can choose a depreciation method and specify parameters such as expected life, salvage value, etc. The  Depreciation tool creates arrays with the periodic depreciation of an asset from a given point in the asset's lifecycle calculated according to a specific method. These arrays are calculated immediately after the Plan model is simulated, and are added to the Plan results to be used later in PetroVR Econ.

Depreciation tool creates arrays with the periodic depreciation of an asset from a given point in the asset's lifecycle calculated according to a specific method. These arrays are calculated immediately after the Plan model is simulated, and are added to the Plan results to be used later in PetroVR Econ.

Within the Depreciation tool the General Tab (Depreciation) allows you to edit the general settings to be applied to all depreciation calculations. Alternative depreciation sets or pools are edited separately as Depreciation Pool nodes.